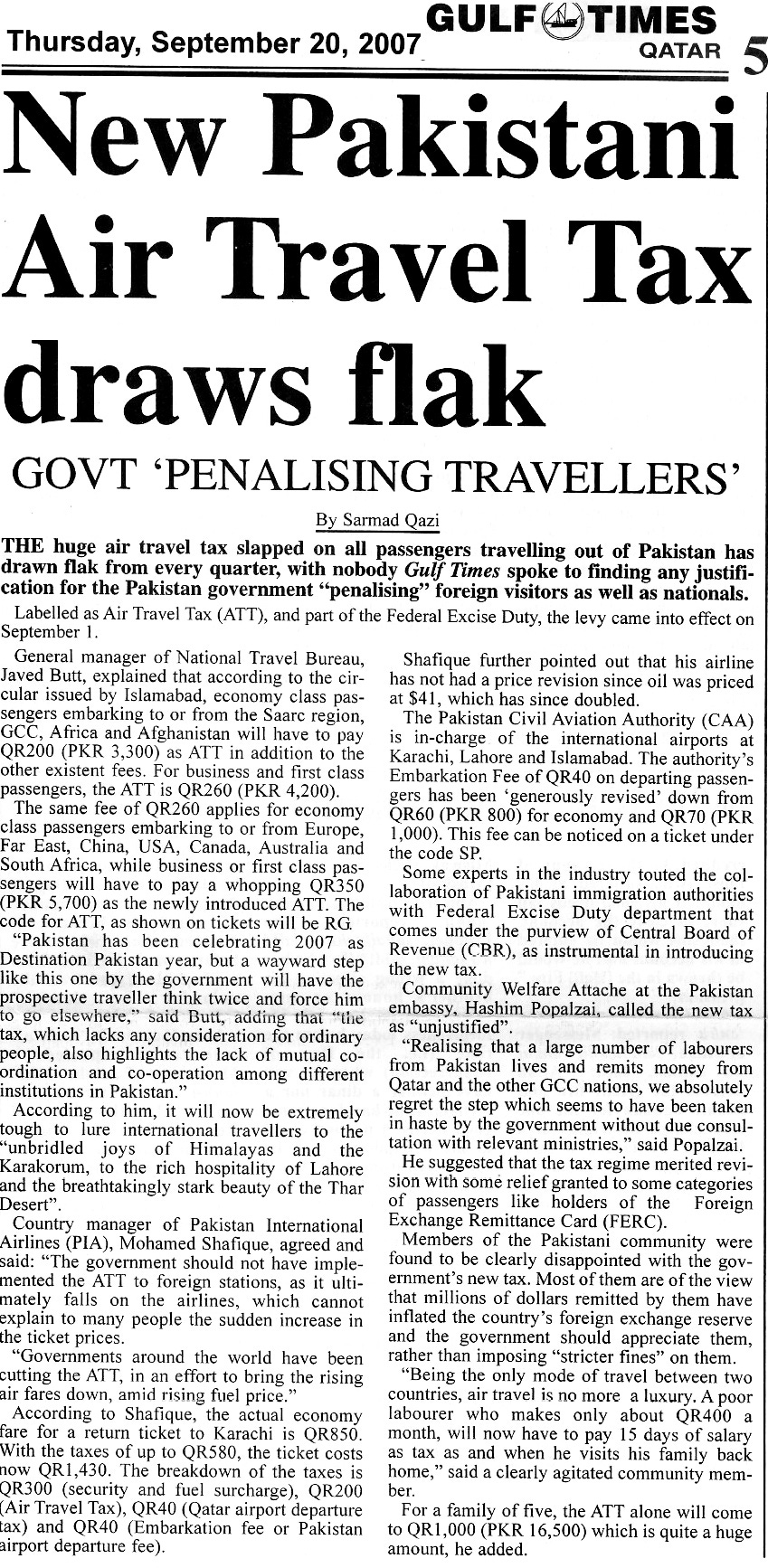

New Pakistani Air Travel Tax draws flak

Originally published in Gulf Times on September 20, 2007

THE huge air travel tax slapped on all passengers travelling out of Pakistan has drawn flak from every quarter, with nobody Gulf Times spoke to finding any justification for the Pakistan government ”penalising” foreign visitors as well as nationals.

Labelled as Air Travel Tax (ATT), and part of the Federal Excise Duty, the levy came into effect on September 1.

General manager of National Travel Bureau, Javed Butt, explained that according to the circular issued by Islamabad, economy class passengers embarking to or from the Saarc region, GCC, Africa and Afghanistan will have to pay QR200 (PKR 3,300) as ATT in addition to the other existent fees. For business and first class passengers, the ATT is QR260 (PKR 4,200).

The same fee of QR260 applies for economy class passengers embarking to or from Europe, Far East, China, USA, Canada, Australia and South Africa, while business or first class passengers will have to pay a whopping QR350 (PKR 5,700) as the newly introduced ATT. The code for ATT, as shown on tickets will be RG.

“Pakistan has been celebrating 2007 as Destination Pakistan year, but a wayward step like this one by the government will have the prospective traveller think twice and force him to go elsewhere,” said Butt, adding that “the tax, which lacks any consideration for ordinary people, also highlights the lack of mutual coordination and co-operation among different institutions in Pakistan.”

According to him, it will now be extremely tough to lure international travellers to the “unbridled joys of Himalayas and the Karakorum, to the rich hospitality of Lahore and the breathtakingly stark beauty of the Thar Desert”.

Country manager of Pakistan International Airlines (PIA), Mohamed Shafique, agreed and said: “The government should not have implemented the ATT to foreign stations, as it ultimately falls on the airlines, which cannot explain to many people the sudden increase in the ticket prices.

“Governments around the world have been cutting the ATT, in an effort to bring the rising air fares down, amid rising fuel price.”

According to Shafique, the actual economy fare for a return ticket to Karachi is QR850. With the taxes of up to QR580, the ticket costs now QR 1,430. The breakdown of the taxes is QR300 (security and fuel surcharge), QR200 (Air Travel Tax), QR40 (Qatar airport departure tax) and QR40 (Embarkation fee or Pakistan airport departure fee).

Shafique further pointed out that his airline has not had a price revision since oil was priced at $41, which has since doubled.

The Pakistan Civil Aviation Authority (CAA) is incharge of the international airports at Karachi, Lahore and Islamabad. The authority’s Embarkation Fee of QR40 on departing passengers has been ‘generously revised’ down from QR60 (PKR 800) for economy and QR70 (PKR 1,000). This fee can be noticed on a ticket under the code SP.

Some experts in the industry touted the collaboration of Pakistani immigration authorities with Federal Excise Duty department that comes under the purview of Central Board of Revenue (CBR), as instrumental in introducing the new tax.

Community Welfare Attache at the Pakistan embassy, Hashim Popalzai, called the new tax as “unjustified”.

“Realising that a large number of labourers from Pakistan lives and remits money from Qatar and the other GCC nations, we absolutely regret the step which seems to have been taken in haste by the government without due consultation with relevant ministries,” said Popalzai.

He suggested that the tax regime merited revision with some relief granted to some categories of passengers like holders of the Foreign Exchange Remittance Card (FERC).

Members of the Pakistani community were found to be clearly disappointed with the government’s new tax. Most of them are of the view that millions of dollars remitted by them have inflated the country’s foreign exchange reserve and the government should appreciate them, rather than imposing “stricter fines” on them.

“Being the only mode of travel between two countries, air travel is no more a luxury. A poor labourer who makes only about QR400 a month, wilI now have to pay 15 days of salary as tax as and when he visits his family back home,” said a clearly agitated community member.

For a family of five, the ATT alone will come to QR 1,000 (PKR 16,500) which is quite a huge amount, he added.